Dubai has always been a hotspot for international investors and expats dreaming of property ownership in the UAE. With attractive prices and low mortgage interest rates, it is understandable why there is so much eagerness to invest here.

If you are thinking of buying a home or investment property in Dubai while you live abroad, then the first thing you need to understand is the eligibility criteria for a Dubai non-resident mortgage.

Knowing what banks expect up front will save you from endless back-and-forth, avoid all last-minute surprises, and also improve your chances of mortgage approval.

In this blog, we will cover the main eligibility requirements for getting a non-resident mortgage in Dubai. Further, we will also discuss types of non-resident mortgages and some prime advantages of investing in property in the UAE.

Who Qualifies as a Non-Resident for a Dubai Mortgage?

In the UAE, a non-resident is someone who primarily lives outside the country and does not hold a residency visa. That is, overseas investors, expatriates who do not hold residency or citizenship in the UAE, or foreign business owners planning to invest in one of the Dubai real estates, are all included in this definition. Unlike their counterparts, non-residents have stricter conditions regarding Dubai mortgage requirements, which primarily concern down payments, required documents, and proof of financial position.

Islamic vs Conventional Mortgages: What Non-Residents Can Choose in Dubai

Property financing in Dubai is available to non-residents through both ethical Islamic financing and conventional loans. Let’s learn briefly what they cover:

Islamic Mortgage: An Islamic mortgage option in Dubai for non-residents is different from a regular loan in that it does not charge interest. Instead, the bank and customer share ownership of the property. It operates on concepts like Ijara (lease-to-own) and Murabaha (cost-plus sale). The customer gradually acquires ownership of the asset from the bank over time through monthly payments. This option is specifically designed for those seeking ethical finance in accordance with Islamic principles.

Conventional mortgage: This functions like a standard home loan, and the bank will lend a fixed amount in return and charge interest on the loan throughout the repayment duration. Both options are widely available in the UAE and offer flexibility in terms of preferences.

What are the Key Eligibility Criteria for Non-Resident Mortgages in Abu Dhabi?

When it comes to getting a mortgage in Dubai for non-residents, there are several criteria you need to fulfil:

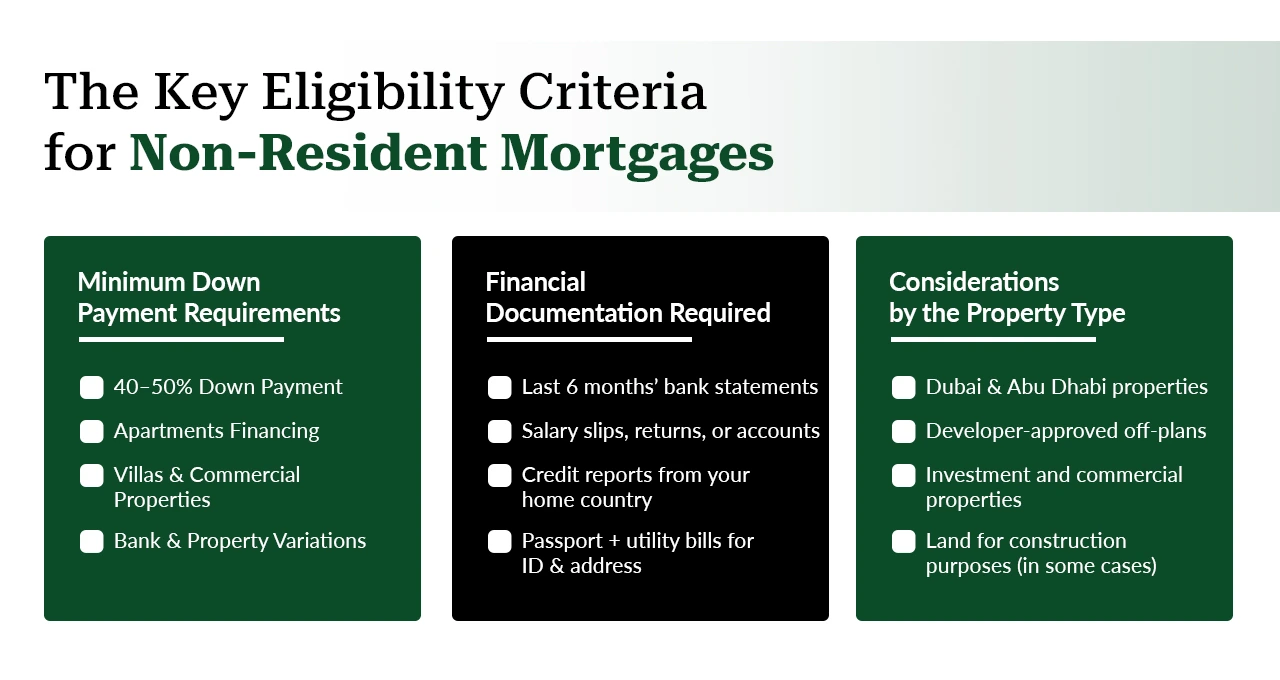

1. Minimum Down Payment Requirements

Most banks, for non-residents, require a minimum down payment of 40-50% of the property value. For apartments, you usually get a rate of 40%, while for villas and commercial properties, it starts at 50% or more. These requirements are part of the standard for getting a mortgage in Abu Dhabi for non-residents and may vary from bank to bank and property to property.

2. Financial Documentation Required

It’s important to note that various financial supports are required if the bank asks for your detailed proof of your financial stability in Abu Dhabi, Dubai, or anywhere else in the UAE:

- Recent 6 months of bank statements.

- Proof of income can include salary slips and tax returns or business accounts.

- Credit reports from your home country.

- Identification and address verification with a passport and utility bills.

The clearer the documentation is provided, the better the chances of securing a Dubai non-resident mortgage.

3. Considerations by Property Type

Not all properties are allowed for getting a Dubai non-resident mortgage. Banks generally approve only:

- Apartments and villas in Dubai or Abu Dhabi.

- Off-plans that are issued approval by the developer.

- Commercial buildings and investment-related properties.

- Land for construction purposes (in some cases).

What are the Benefits of investing in UAE property for non-residents?

Non-resident property investment in the UAE comes with incredible benefits. The most important advantage is the tax-free environment through which rents can be derived without incurring property or capital gains tax. The other factors contributing to the long-term appreciation of real estate in the UAE are its robust economy and strategic location.

In addition, the highly structured property market ensures transparency and safety. Owning property in the UAE, with its remarkable infrastructure that attracts great demand for rentals, could yield good returns for a non-residential investor.

Frequently Asked Questions( FAQs)

Certainly, foreigners from the eligible countries, including those from Europe, the UK, GCC, India and Canada, can get a non-resident mortgage in the UAE. Partnering with a trusted online mortgage brokerage will help you navigate the process smoothly.

If you have a steady income, a valid passport, and financial documents, you’re good to go. You should also have a better understanding of lending rules for non-resident mortgages used by banks across Dubai, Abu Dhabi, and all over the UAE.

Not at all. But the process can be a bit tricky. It is essential that you partner with a leading mortgage online brokerage to understand the complete process and speed things up.

Non-residents typically need around a 40–50% down payment, proof of income, and a valid passport. Talk to a trusted mortgage broker in Dubai for full guidance.

Conclusion: Secure Your Non-Resident Dubai Mortgage the Smart Way with Prime Rate Hub

As a non-resident, buying property in Dubai, Abu Dhabi, or the UAE is easily achievable. You just need clear planning and expert support.

At Prime Rate Hub, we specialise in helping non-residents secure the right Dubai mortgage with maximum ease, comfort, and reliability. Be it in the form of ethical Islamic financing or as a conventional loan facility, we customise and tailor solutions to suit your very individual needs.

As a trusted mortgage broker operating in Dubai and Abu Dhabi, we have brought ease to the hassle of mortgage processing. Providing expert guidance at each step, we also have a strong network with top banks that makes it easy to get the best competitive rates.

From non-resident property loans to refinancing and financing commercial properties, Prime Rate Hub ensures a seamless, transparent, and hassle-free experience toward property ownership in the UAE.