Buying a home in the UAE is a big step, and the mortgage you choose affects your money every month. Many people move forward without fully understanding how interest rates work. This can later lead to stress as well as confusion.

Many homeowners feel confused when their monthly payment changes without warning. One month it feels manageable, and another month it suddenly goes up. This often happens because of a rate that works quietly in the background and affects most home loans in the UAE. When people do not understand how this rate works, they struggle to decide whether to fix their mortgage or let it change over time.

Let’s break down EIBOR in a simple way, explain how it affects your mortgage, and help you feel more confident when choosing or reviewing your home loan in the UAE.

What Does EIBOR Actually Mean?

EIBOR stands for Emirates Interbank Offered Rate. It is the benchmark interest rate used by banks in the UAE when they lend money to each other. Every business day, UAE banks submit their borrowing rates to the Central Bank of the UAE. The Central Bank removes the highest and lowest figures, averages the rest and publishes the official EIBOR rate.

Why Does EIBOR Matter for Your Mortgage?

Most variable and hybrid home loans in the UAE are calculated like this:

Mortgage interest rate = EIBOR + bank margin

That means:

- When EIBOR rises, your monthly payment usually increases

- When EIBOR falls, your payment may reduce (unless your loan has a floor rate)

That is why many people ask, “How does EIBOR affect my monthly mortgage payment in the UAE?” Understanding this helps you decide between fixed, variable or hybrid mortgages.

How Often Does EIBOR Change, and Why Should You Care?

When you are planning a home loan, small rate changes can make a big difference over time. Many people hear about EIBOR but are not sure how often it moves or how it affects their monthly payment. Let’s explain this in a very simple way.

EIBOR is updated every working day. Banks review it daily, and the official rate is published by the Central Bank of the UAE. That means the number itself can go up or down from one day to the next.

Precise average annual values based on official Central Bank daily fixings?

However, your mortgage does not change every day. Most home loans in the UAE update their interest rate once every 3 months or sometimes every 1 month. That is why many banks use the 3-month EIBOR as their main reference.

This matters a lot if you are thinking, “Is this the right time to choose a variable mortgage in Abu Dhabi?” If EIBOR goes up, your payment may increase at the next reset. If it goes down, your payment could be reduced. Understanding this timing helps you plan better and avoid surprises later.

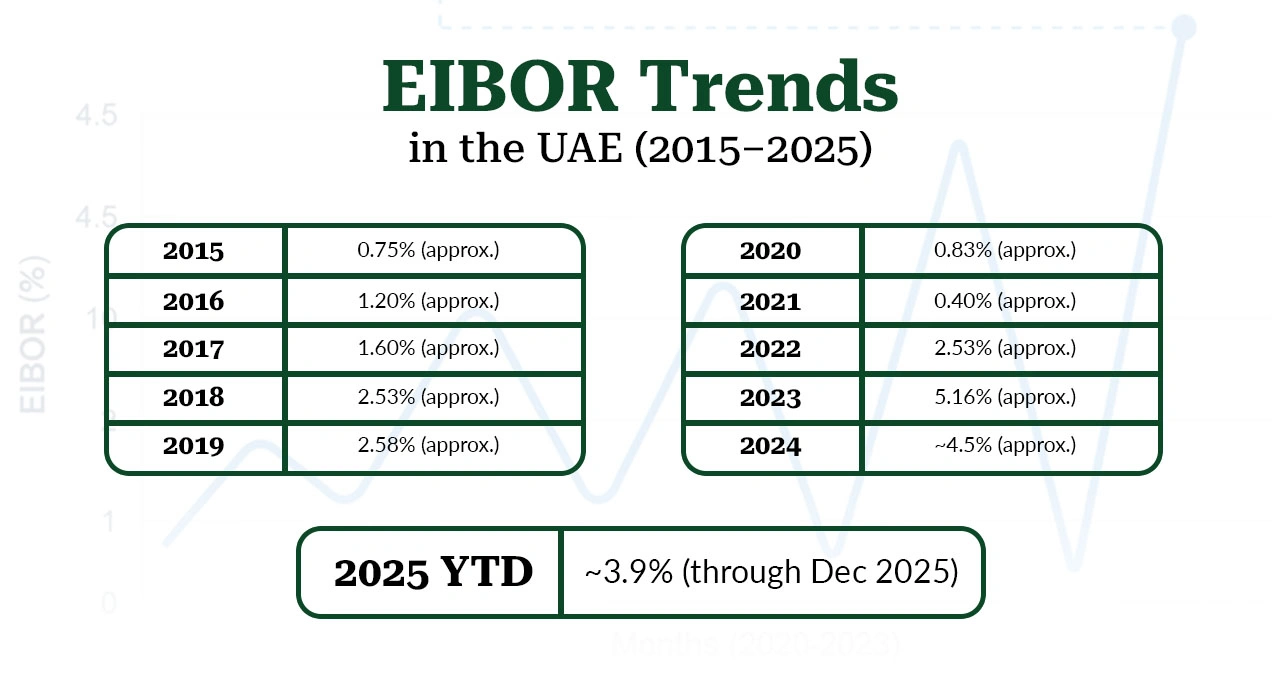

EIBOR trends in the UAE (2015–2025)

According to official UAE Central Bank data (daily EIBOR fixings), the annual average 3‑month EIBOR for each year 2015–2025 (YTD) is approximately as follows:

| Year | Average 3‑Month EIBOR (% p.a.) |

| 2015 | 0.75% (approx.) |

| 2016 | 1.20% (approx.) |

| 2017 | 1.60% (approx.) |

| 2018 | 2.53% (approx.) |

| 2019 | 2.58% (approx.) |

| 2020 | 0.83% (approx.) |

| 2021 | 0.40% (approx.) |

| 2022 | 2.53% (approx.) |

| 2023 | 5.16% (approx.) |

| 2024 | ~4.5% (approx.) |

| 2025 YTD | ~3.9% (through Dec 2025) |

Fixed or Variable: Which Mortgage Suits EIBOR Better?

Choosing the right mortgage type can feel confusing, especially when EIBOR keeps changing. Many home buyers are unsure which option will give them peace of mind and which one can save money over time. Here is a simple way to understand your choices.

1. Fixed-Rate Mortgage

With a fixed rate, your monthly payment stays the same for a set time. This is a good option if you want stability and do not want surprises in your budget.

2. Variable Rate Mortgage

A variable rate moves with EIBOR. When EIBOR goes down, your payment may also go down. When it goes up, your payment can increase. This option works best if you are comfortable with changes.

3. Hybrid Mortgage

A hybrid mortgage starts with a fixed rate and later switches to a variable rate linked to EIBOR. It always gives you stability first and flexibility later.

How Prime Rate Hub Supports UAE Home Buyers

Buying or refinancing a home is a big decision, and clear advice makes it easier. At Prime Rate Hub, we focus on guiding you at every step, not just sharing numbers.

We help by:

- Comparing banks to find a low-interest mortgage in Abu Dhabi

- Checking which UAE banks you are eligible for

- Explaining how EIBOR may affect your future payments

- Supporting you with refinancing and rate checks when needed

This simple, as well as honest, approach helps home buyers feel confident and avoid unexpected costs later.

Ready to Make Smarter Mortgage Choices?

Understanding EIBOR gives you more control over your home loan and your monthly payments. When you know how rates work, it becomes easier to plan, choose the right option, and avoid stress later.

At Prime Rate Hub, we help you find the right mortgage without confusion or pressure. Our team compares banks, explains everything in simple words, and guides you from start to finish. Whether you are buying your first home or reviewing an existing loan, we are here to help you move forward with confidence.

Reach out to US today and take the next step towards a better mortgage decision.

FAQs:

Most home loan rates in the UAE follow EIBOR. Banks use it as the base rate and then add their own margin on top.

Every day, UAE banks share the rates at which they can borrow money from each other. The Central Bank of the UAE removes the highest and lowest numbers and then takes an average. This final number becomes EIBOR.

EIBOR changes daily, so there is no single fixed number. The current rate is published on the Central Bank of the UAE website and is updated every working day.

If your mortgage is linked to EIBOR, your monthly payment can go up or down when EIBOR changes. When EIBOR rises, payments may increase. When it falls, payments may reduce, depending on your loan terms.