Property Services

Below is everything we can assist you with.

Property Services

Your property deserves expert care ,whether you’re moving in, investing, or managing from abroad. At Prime Rate Hub, we offer complete property services across Dubai and Abu Dhabi. From detailed snagging inspections and smooth handover support to reliable property maintenance, non resident bank account setup, and Golden Visa guidance,we make sure your property experience in the UAE is hassle free and professionally managed

Why choose our Property Services?

We know the UAE property market inside out. What sets us apart? Independent inspections, transparent pricing, and expert local support from start to finish. Whether you’re a first time buyer or seasoned investor, we offer peace of mind with every service. No fluff just professionals who get things done right the first time.

Your journey to ownership starts here

Tailored Property Services

Snagging and Handover Inspection

Before you finalize your new home purchase, make sure every detail is perfect.

Read More

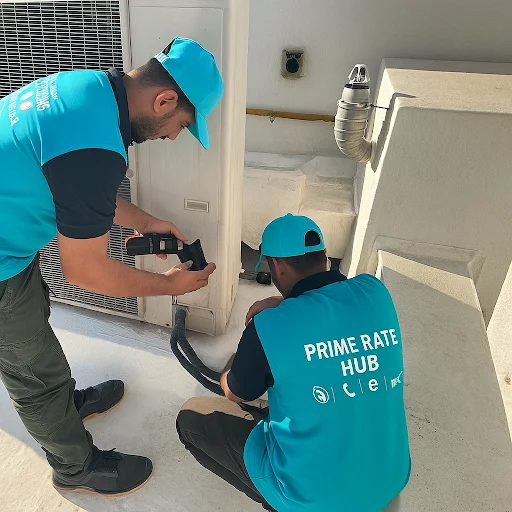

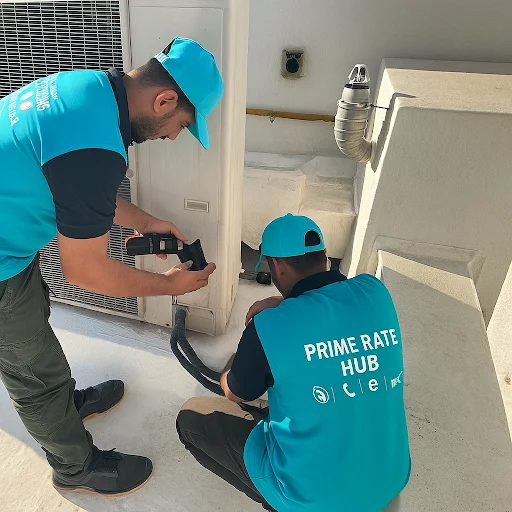

Property Maintenance Services

Keep your property in excellent condition without dealing with multiple companies.

Read More

Bank Account Opening for Non-Residents

Opening a bank account in the UAE as a non resident can be confusing and time consuming.

Read More

Golden Visa Services

Unlock long-term residency and global opportunities through qualified investments.

Read MoreYour journey to ownership starts here

Tailored Property Services

Simple steps to secure your rate

Your mortgage journey

We work with the top banks in UAE

FAQ'S

How does an Islamic mortgage work in the UAE?

Islamic mortgages don’t charge interest. Instead, banks use Shariah-compliant structures like Ijara (lease-to-own) or Murabaha (cost-plus sale). These methods make sure your financing stays ethical and aligned with Islamic law.

Who can apply for a Shariah-compliant mortgage?

Both UAE nationals and expats can apply, and non-residents to get Islamic mortgages with the right documents.

How much down payment is required?

The minimum down payment is usually 15% for UAE nationals and 20 % for expatriates for properties up to AED 5 million. For higher-value or investment properties, the requirement can range from 30% to 40%.

What properties are eligible in Dubai and Abu Dhabi?

- Islamic mortgages can be used to purchase apartments, villas, townhouses, Offices across Abu Dhabi, Dubai, and other emirates. They are also available for investment properties, not just primary residences.

How fast can I get approved?

With the right documents, pre-approval can happen in a couple of days. Full approval generally takes about two weeks.

Your mortgage journey starts here

Get in touch