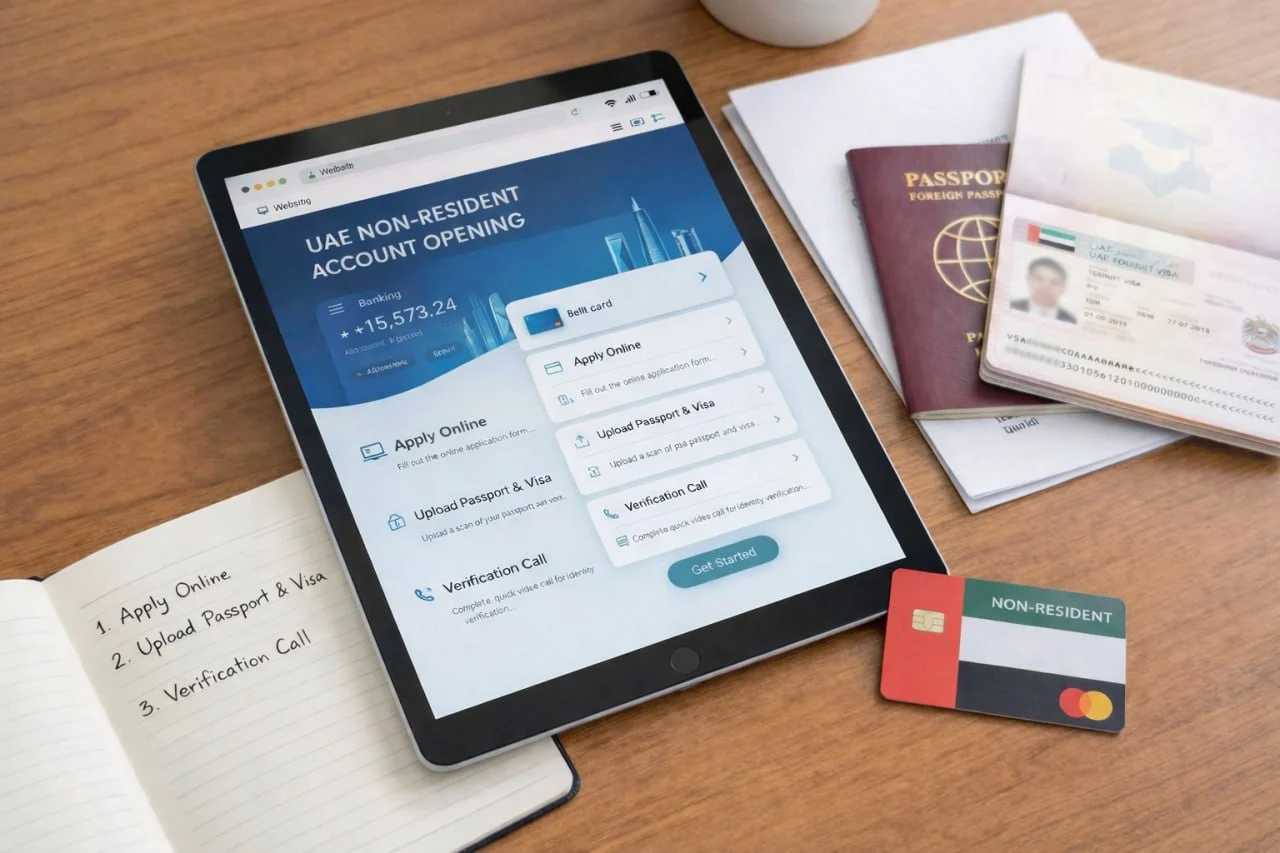

Bank Account Opening for Non Residents

Bank Account Opening for Non Residents

Opening a bank account in the UAE as a non-resident can be confusing and time consuming. We remove the barriers by handling the entire process on your behalf. Whether you’re purchasing property, investing, or setting up business operations, we help you open the right account smoothly and without delays.

Why Non Residents Choose This Service

Access global and UAE financial services

Hold, send, and receive funds in multiple currencies

Simplify property purchases and investment transactions

How We Support You

Consultation

We analyze your needs and recommend the most suitable banks and account types.

Document Preparation

We assist with preparing the required documents, such as passport copies, proof of address, proof of income, or source of funds.

Application Submission

We coordinate directly with the bank and manage the process on your behalf.

Account Activation

We guide you through the final steps until your account is active and ready to use.

Why Work With Us

Deep knowledge of banks that welcome non-resident clients

Higher approval success rates

Time saving, stress free process

Ongoing compliance support when needed

Start your account application today.

Contact us for a free consultation.

Access global and UAE financial services Hold, send, and receive funds in multiple currencies Simplify property purchases and investment transactions

How We Support You

Consultation

We analyze your needs and recommend the most suitable banks and account types.

Document Preparation

We assist with preparing the required documents, such as passport copies, proof of address, proof of income, or source of funds.

Application Submission

We coordinate directly with the bank and manage the process on your behalf.

Account Activation

We guide you through the final steps until your account is active and ready to use.

Why Work With Us

Deep knowledge of banks that welcome non-resident clients Higher approval success rates Time saving, stress free process Ongoing compliance support when needed

Your journey to ownership starts here

Tailored mortgage solutions

Islamic Mortgages (Shariah-Compliant)

Ethical, interest-free mortgage solutions aligned with Shariah principles.

Read More

New Purchase - Resale & Final Payment

Unlock competitive mortgage rates tailored to your unique financial goals.

Read More

Refinance – Buyout and Equity Release

We help you refinance for better rates, equity access, or lender flexibility, giving you more control over your finances.

Read More

Plot and Construction Financing

Flexible financing designed to help you purchase vacant land for future construction or investment opportunities.

Read More

Commercial Property Finance

Tailored financing for offices, residential blocks, warehouses, and mixed-use developments, built for commercial property buyers.

Read More

Non-resident mortgages

Specialized mortgage solutions for non-residents investing in UAE property.

Read More

Investment Property Financing

We help investors secure mortgage solutions for rental and income-generating properties across the UAE. Whether you're buying your first unit or expanding your portfolio, we’ll guide you to the best bank offers, terms, and approvals

Read More

Property Valuation Services

Get accurate, bank-approved property valuations for buying, selling, or refinancing. We work with certified valuers to ensure a smooth mortgage process and fair market pricing

Read MoreSimple steps to secure your rate

Your mortgage journey

We work with the top banks in UAE

FAQ'S

What is plot and construction financing in UAE?

It’s a loan that helps you buy land and build your property on it—ideal if you want to design your own villa or townhouse. The bank disburses funds in stages, aligned with construction progress.

How much financing can I get?

UAE nationals can get up to 60–65% financing, while expats usually get up to 60%. The rest will be your equity contribution.

What documents are required?

Passport, Emirates ID (for residents), proof of income, six months of bank statements, plot title deed, and approved construction plans with contractor details.

Can I finance off-plan projects under construction finance?

No, construction finance is for self-build projects or when you own the plot. Off-plan properties usually fall under developer-linked payment plans with mortgage support.

How long does approval take?

Pre-approval comes in a few days. Full approval and first disbursement usually take 2–3 weeks, after which funds are released in phases as construction advances.

Your mortgage journey starts here

Get in touch